The Impact of Tariffs on Traditional Investment Strategies

April 21, 2025 - 07:30

The traditional 60/40 investment portfolio, which allocates 60% to stocks and 40% to bonds, is facing significant challenges in the current economic climate shaped by tariffs and rising inflation. Economist Lauren Goodwin has pointed out that this classic strategy was primarily developed for periods of low inflation and stable economic growth. With the ongoing trade tensions and tariff impositions, the assumptions underlying this investment model are being called into question.

As tariffs increase costs for consumers and businesses alike, the resulting inflationary pressures are forcing investors to reconsider their approaches. The once-reliable balance of stocks and bonds may not provide the same level of risk mitigation in a volatile market influenced by geopolitical factors. Investors are now urged to explore alternative strategies that account for the unpredictability of trade policies and their impact on various asset classes.

In this shifting landscape, adaptability and a keen understanding of macroeconomic trends will be crucial for investors seeking to navigate the complexities of a tariff-driven economy.

MORE NEWS

February 1, 2026 - 02:20

A mystery vending machine appeared at Pentagon. Then it vanished.A strange and unexpected installation briefly captured the attention of personnel at the Pentagon last week: a fully functional, unmarked vending machine. Appearing without fanfare in a building...

January 31, 2026 - 02:38

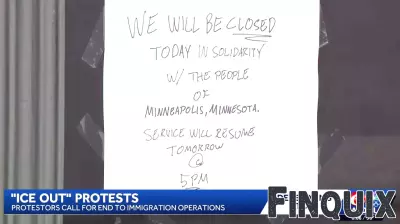

'ICE out' movement sparks protests, temporary business closures in New OrleansA growing movement calling for the removal of Immigration and Customs Enforcement (ICE) agents from the city has led to protests and temporary business closures in New Orleans this week....

January 30, 2026 - 21:56

Year three of our transformationAs it enters a pivotal third year of its strategic evolution, the global business and technology publisher reports accelerating momentum and a clear roadmap centered on deepening audience...

January 30, 2026 - 07:15

Businesses in the Triangle feeling the effects of winter weatherLocal enterprises across the Triangle are facing significant financial pressure following consecutive winter weather events. The repeated weekend storms have forced numerous shops and restaurants...