The Decline of the US Dollar: Insights from Experts

April 26, 2025 - 09:23

The US Dollar Index has experienced a significant decline of 8% since the beginning of the year, reaching its lowest level in three years. This downward trend has raised concerns among economists and market analysts, who suggest that the dollar may have even further to fall.

Several factors contribute to this decline, including shifts in monetary policy, inflationary pressures, and global economic uncertainties. Analysts point out that as the Federal Reserve navigates interest rate adjustments, the dollar's strength is closely tied to investor confidence and economic indicators.

Market experts are closely monitoring the situation, emphasizing that the current bear market for the dollar could impact various sectors, including trade and investment. The weakening greenback may lead to increased costs for imports and could influence inflation rates domestically.

As the situation unfolds, many are left wondering how long this trend will persist and what it means for the broader economy. The implications of a declining dollar are far-reaching, making it a critical topic for ongoing analysis.

MORE NEWS

February 1, 2026 - 02:20

A mystery vending machine appeared at Pentagon. Then it vanished.A strange and unexpected installation briefly captured the attention of personnel at the Pentagon last week: a fully functional, unmarked vending machine. Appearing without fanfare in a building...

January 31, 2026 - 02:38

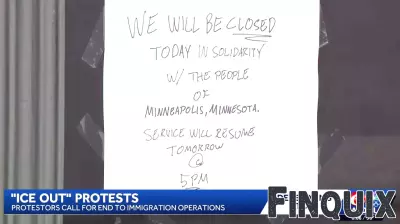

'ICE out' movement sparks protests, temporary business closures in New OrleansA growing movement calling for the removal of Immigration and Customs Enforcement (ICE) agents from the city has led to protests and temporary business closures in New Orleans this week....

January 30, 2026 - 21:56

Year three of our transformationAs it enters a pivotal third year of its strategic evolution, the global business and technology publisher reports accelerating momentum and a clear roadmap centered on deepening audience...

January 30, 2026 - 07:15

Businesses in the Triangle feeling the effects of winter weatherLocal enterprises across the Triangle are facing significant financial pressure following consecutive winter weather events. The repeated weekend storms have forced numerous shops and restaurants...