Major IRS Changes: What Businesses Need to Know

April 22, 2025 - 04:59

Significant transformations are occurring at the IRS, marked by substantial workforce reductions and budgetary adjustments that are altering the agency's operational landscape. These changes signal a pivotal moment for businesses, necessitating a reevaluation of tax strategies to navigate the evolving regulatory environment effectively.

As the IRS streamlines its operations, businesses may experience shifts in how audits are conducted and how tax compliance is enforced. This could lead to new challenges, including potential delays in processing returns and refunds. However, there are also opportunities for savvy business owners to optimize their tax positions amidst these changes.

To stay ahead, businesses should consider consulting with tax professionals who are well-versed in the latest IRS developments. By proactively adapting to the new rules and understanding their implications, companies can ensure they are not only compliant but also positioned to maximize their financial outcomes in this changing landscape. Taking these steps now will help mitigate risks and capitalize on potential advantages in the future.

MORE NEWS

February 1, 2026 - 02:20

A mystery vending machine appeared at Pentagon. Then it vanished.A strange and unexpected installation briefly captured the attention of personnel at the Pentagon last week: a fully functional, unmarked vending machine. Appearing without fanfare in a building...

January 31, 2026 - 02:38

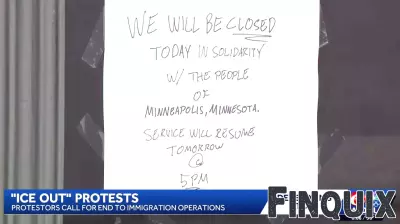

'ICE out' movement sparks protests, temporary business closures in New OrleansA growing movement calling for the removal of Immigration and Customs Enforcement (ICE) agents from the city has led to protests and temporary business closures in New Orleans this week....

January 30, 2026 - 21:56

Year three of our transformationAs it enters a pivotal third year of its strategic evolution, the global business and technology publisher reports accelerating momentum and a clear roadmap centered on deepening audience...

January 30, 2026 - 07:15

Businesses in the Triangle feeling the effects of winter weatherLocal enterprises across the Triangle are facing significant financial pressure following consecutive winter weather events. The repeated weekend storms have forced numerous shops and restaurants...