Accelerating Payments: A Necessity for Small Businesses

May 3, 2025 - 11:32

Small businesses are grappling with a myriad of challenges, including persistent inflation, ongoing labor shortages, and escalating costs of goods. In these tough macroeconomic conditions, the need for efficiency and access to capital has never been more urgent. Small business owners are often pressed for time and resources, making it essential for payment systems to keep pace with their fast-moving operations.

Policymakers have a unique opportunity to support these vital economic players by modernizing the infrastructure that underpins business transactions. Streamlining payment processes can significantly enhance cash flow, allowing small businesses to allocate resources more effectively and respond to market demands swiftly. By embracing technological advancements and simplifying payment methods, governments can help reduce the burdens faced by small enterprises.

In a landscape where every second counts, ensuring that payment systems are agile and responsive is crucial for the survival and growth of small businesses. This modernization could provide the much-needed boost to help them thrive amidst ongoing economic challenges.

MORE NEWS

February 1, 2026 - 02:20

A mystery vending machine appeared at Pentagon. Then it vanished.A strange and unexpected installation briefly captured the attention of personnel at the Pentagon last week: a fully functional, unmarked vending machine. Appearing without fanfare in a building...

January 31, 2026 - 02:38

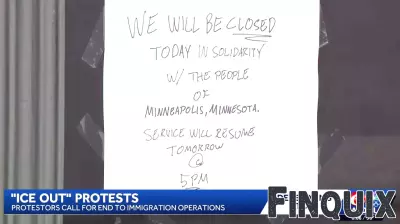

'ICE out' movement sparks protests, temporary business closures in New OrleansA growing movement calling for the removal of Immigration and Customs Enforcement (ICE) agents from the city has led to protests and temporary business closures in New Orleans this week....

January 30, 2026 - 21:56

Year three of our transformationAs it enters a pivotal third year of its strategic evolution, the global business and technology publisher reports accelerating momentum and a clear roadmap centered on deepening audience...

January 30, 2026 - 07:15

Businesses in the Triangle feeling the effects of winter weatherLocal enterprises across the Triangle are facing significant financial pressure following consecutive winter weather events. The repeated weekend storms have forced numerous shops and restaurants...